Dear Investor,

My son advised me that he had used ChatGPT to create a study guide for his biology class final and instructed it to assume he had skipped a decent percentage of the classes during the semester in order to focus on his computing classes, and that this would be the only material he would use to study for the exam. I had mixed feelings. On the one hand, I did not like the fact that he was skipping classes, but on the other hand I admired his creativity and thankful that he was learning “something” in college. ChatGPT is a natural language processing tool driven by artificial intelligence “AI” technology that allows one to have human- like conversations with the chatbot. Being one of the fastest growing applications of all time, industry pundits and Wall Street analysts are claiming that this technology will bring Internet-level disruption. Investors have responded by crowding into a few mega cap technology names. Although Pier 88’s research team believes no one really can predict how this technology trend will impact the business world, we do believe the AI euphoria has created an asymmetrical investment opportunity for small and mid-cap innovation companies that have largely been left behind during this hype cycle. In our view, the Lake Geneva strategy presents an attractive way to capitalize on this opportunity.

During the first half of 2023, the hedged version of the Geneva strategy outperformed its relevant benchmark due to strong security selection and good risk management, while the long only version posted strong double-digit absolute returns. That said, small and mid-cap companies lagged the broader larger cap indices as investors crowded into a small handful of mega cap stocks. Concentration risk in the S&P 500 is now higher than was at the very peak of the dot com bubble in 2000 with the largest five stocks representing 24% of the S&P 500’s market capitalization, compared to 19% in March 2000. See Chart Below:

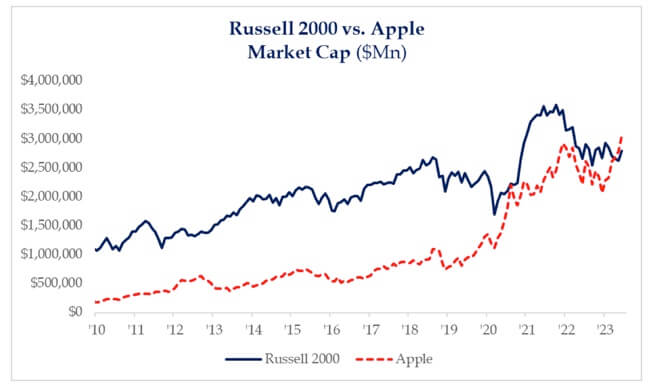

The initial move into these large names was a tactical defensive move from investors during the high-profile collapse of several regional banks in Q1. Investors essentially sought refuge in these large companies with strong balance sheets that had promised layoffs to protect margins. This trade accelerated after NVDA delivered strong earnings and attributed the strength to demand for AI applications. The Pier 88 Team are longtime fans of these technology franchises, but submit that the opportunity to generate significant returns from here lies somewhere else. The following chart is illustrative.

AAPL’s market capitalization now exceeds the combined market cap of the Russell 2000 index. Having worked at a former large cap technology darling that no longer exists, we are cognizant that competitive advantage in the technology world can be ephemeral, especially in the midst of a broader technological shift. Although our team cannot predict the ultimate winners of a disruptive trend, we do know that these five mega cap companies do not have a monopoly on AI innovation. Approximately 75% of Geneva portfolio companies have made public announcements of incorporation of AI technology into product or service offering or in business operations to create efficiencies.

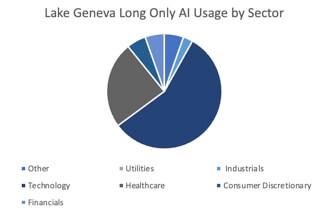

What we find most exciting is the fact that we are seeing broad experimentation and adoption of AI across multiple sectors. Having been involved during the early days of Cloud Computing in the early 2000’s, our team is very aware that technological paradigms shifts like AI, tend to take much longer to adopt than pundits initially think, but ultimately can have much larger impacts. One simple example of this is mobile computing which strategy consultants initially projected to be a fairly niche business for Motorola.

The rebound in the markets this year is a welcome relief from the volatility in 2022. Where is the opportunity from here? Our team has compiled a simple Top 10 list of why we believe the Lake Geneva strategy offers a compelling opportunity over the next several years:

- Apple market capitalization now greater than entire R2000.

- Simple reversion to mean makes case for increase to asset class.

- Extreme valuation differential between small cap versus mega cap securities.

- Non-cyclical revenue exposure compounding at 30% per year.

- Disruptive innovation via multiple growth vectors and access to strategic assets.

- Strategy has delivered 6 take-outs per year (on average) — 53 in total1.

- Heightened take-out premiums from Strategics or P/E as multiples hit lows to growth rates.

- Take-out “put” coupled with lack of cyclical earnings provides downside protection untilrecession fears recede.

- Small cap stocks generally lead out of a recession.

- Small capitalization stocks will benefit from declining rates as fed eventually unwinds ratehikes.

Pier 88’s Team does not need the assistance of an AI tool to identify a compelling risk-adjusted investment opportunity that has not existed in the public or private markets for some time. Every business in the portfolio is not only levered to secular growth trends for the next few years, but the markets have also created a scenario wherein each company presents a call-option for an exit via M&A or private equity take- out. With 53 announced acquisitions1 for the strategy since its inception in 2013, our team identifies a common pattern. Great growth franchises that trade at a discount get acquired by the bigger guys. We anticipate the dramatic sell-off in small and midcap growth assets which started last year will lead to a massive consolidation opportunity over the next 12-18 months. The strategy benefitted from 2 acquisitions in the first half of 2023 and has average 6 per year since inception.

We humbly submit that now is the time for thoughtful investors to position for outsized returns over the next few years by calmly embracing an under-utilized investment tool….duration of time. We are so grateful for the support and confidence of our clients, and view our responsibility as a steward of capital as a privilege. We look forward to connecting with you soon.

Thank you for your support and we look forward to connecting with you soon.

Respectfully,

Frank

Disclosures

This newsletter is a proprietary publication and the property of Pier 88 Investment Partners, LLC (“Pier 88”). The publication is written to express our view of the market and to explain our investment philosophy. It is not intended to provide specific investment advice or to guarantee that any past performance will be indicative of future performance results; investments may lose money. Certain statements contained in this newsletter (such as those that contain words like “may,” “will,” should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe”) are “forward-looking” insofar as they attempt to describe beliefs or future events. No representation or warranty is made as to future performance or such forward- looking statements. Any reproduction or other unauthorized use is strictly prohibited. All information contained in the newsletter was obtained from sources deemed qualified and reliable; however, Pier 88 makes no representation or warranty as to the accuracy of the information contained herein. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

This newsletter is for discussion purposes only and does not constitute: (i) investment advice; or (ii) an offer to sell or a solicitation of an offer to purchase securities, including any securities in funds managed by Pier 88. Any fund offering is made to selected investors only by means of a complete confidential offering memorandum and related subscription materials. Advisory services are provided to separately managed account clients pursuant to an advisory agreement.

Performance results of the Lake Geneva Strategy are presented for information purposes only and reflect the impact that material economic and market factors had on the manager’s decision-making process. Results are net of all standard fees calculated at the highest rate charged, expenses and estimated incentive allocation. Lake Geneva Strategy returns are inclusive of the reinvestment of dividends and other earnings, including income from new issues. Returns may vary for investors.

The holdings identified do not represent all of the securities purchased, sold, or recommended for the Lake Geneva Strategy. It should not be assumed that investments made in the future will be profitable or will equal the performance of the securities in this list. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the account’s performance during the period will be provided upon request.

S&P 500 Comparison: Results for the Lake Geneva Strategy as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”) is for informational purposes only. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The investment program does not mirror this index and the volatility may be materially different than the volatility of the S&P 500.

Russell 2000 Indices: Results for the Lake Geneva Strategy as compared to the performance of the Russell 2000 Index (“Russell 2000”) and the Russell 2000 Growth Index (“Russell 2000 Growth”) are provided for informational purposes only. Russell 2000 and Russell 2000 Growth are unmanaged indices of 2,000 small cap companies located in the U.S.; Russell 2000 Growth companies are those that exhibit a growth probability. The investment program does not mirror this index and the volatility may be materially different than the volatility of the Indices.

These materials are not intended to constitute investment advice or a recommendation within the meaning of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), or the Department of Labor regulations at 29 CFR 2510.3-21. If you are, or are using any assets of, or are acting on behalf of, an employee benefit plan subject to ERISA or a plan or account subject to Section 4975 of the Code (including, without limitation, an individual retirement account) (any of such entities, a “Plan”), you will be required prior to any new or additional investment in one of our funds or accounts to represent and warrant that: (i) the person or entity making the investment decision on behalf of the such Plan (the “Plan Fiduciary”) is independent of us and constitutes an independent fiduciary with financial expertise within the meaning of 29 CFR 2510.3-21; (ii) the Plan Fiduciary is capable of evaluating investment risks independently, both in general and with regard to particular transactions and strategies; (iii) the Plan Fiduciary is a fiduciary under ERISA, the Code, and 29 CFR 2510.3-21with respect to the investment in such fund or account and is responsible for exercising independent judgment in evaluating such transaction; and (iv) no fee or other compensation is being paid directly to us or to any of our affiliates in connection with such transaction. The Plan Fiduciary also will be required to acknowledge that we are not undertaking to provide impartial investment advice, or to give advice in a fiduciary capacity, in connection with the investment in any such fund or account, and that we have financial interests in the operation of such funds and accounts, which will be described in constituent documents of the funds and accounts.

The companies identified do not represent all of the companies purchased, sold or recommended for portfolios advised by Pier 88 Investment Partners, LLC. The reader should not assume that investment in any company was or will be profitable. Additional information including a list of all companies is available upon request.