Following strong performance of convertible bonds over the last several years, savvy investors are beginning to take notice of the attractive characteristics of this unique asset class. The hybrid construction of convertibles can offer a compelling way to participate in risk on markets while offering some downside support during market pullbacks. Pier 88’s Investment Team posits that convertibles are a defensive way to gain exposure to growth stocks with less volatility. We believe the case study of next generation healthcare technology company Tabula Rasa Healthcare, Inc. (“TRHC”) is demonstrative.

TRHC specializes in offering patient-specific, data-driven technology and solutions, empowering healthcare organizations to enhance patient outcomes by optimizing medication regimens. Innovative companies like TRHC tend to be attracted to the convertible bond market as it allows them to raise capital at lower interest rates in a manner that is less dilutive than straight equity. Investors are attracted to convertibles from companies like TRHC as the risk of default is generally low (especially for technology companies) and provides the investor with a call option on the company’s future growth. Further, there is a potential benefit of M&A optionality. Pier 88’s investment process focusing on disruptive innovators identified TRHC as a company which we believed would likely be deemed strategic to a larger industry player. And it was.

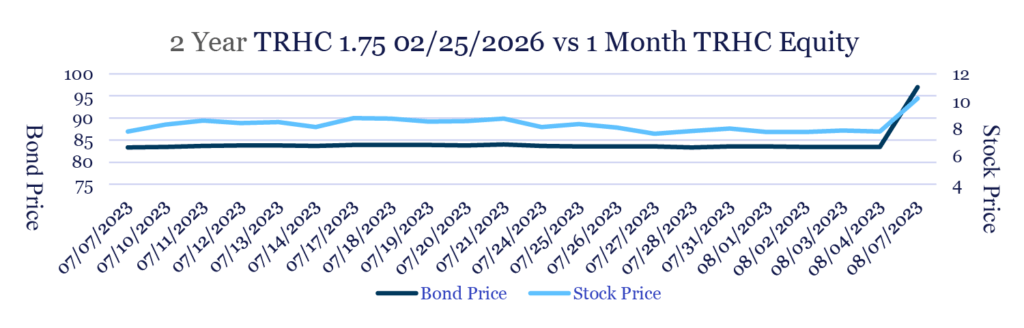

August 7th, 2023, TRHC announced that it had entered into a definitive agreement to be acquired by Nautic Partners[1], a leading private equity investment firm, in an all-cash transaction that valued TRHC at approximately $570 million enterprise value. The deal also includes the assumption of $262 million in debt. Under the terms of the agreement, TRHC shareholders will receive $10.50 per share in cash, representing a premium of approximately 34% percent over TRHC’s closing share price on August 4, 2023. As depicted below the stock jumped on the news of transaction and the convertible bond had a sharp positive move as well.

Bondholders were rewarded as the market price for the convertible bond played offense following the equity move up and jumped from approximately $83 to $97 (+16.9% move).

The recent downturn in small and mid-cap growth equities has significantly impacted convertible bonds issued by growth-focused companies. As these equities have declined, the associated convertibles have fallen below par value, creating an intriguing investment opportunity. Despite their current under-par pricing, we believe the inherent structure of convertible bonds enables substantial upside potential if equities rebound, potentially surpassing par value. This distinctive asymmetrical risk-reward appeal has attracted investors aiming to benefit from potential gains while safeguarding against downside risk in the current market climate. Moreover, the prospect of convertibles accreting to par upon maturity, irrespective of market conditions, adds another layer of security, with the potential for an immeditate jump to par upon acquisition scenarios.

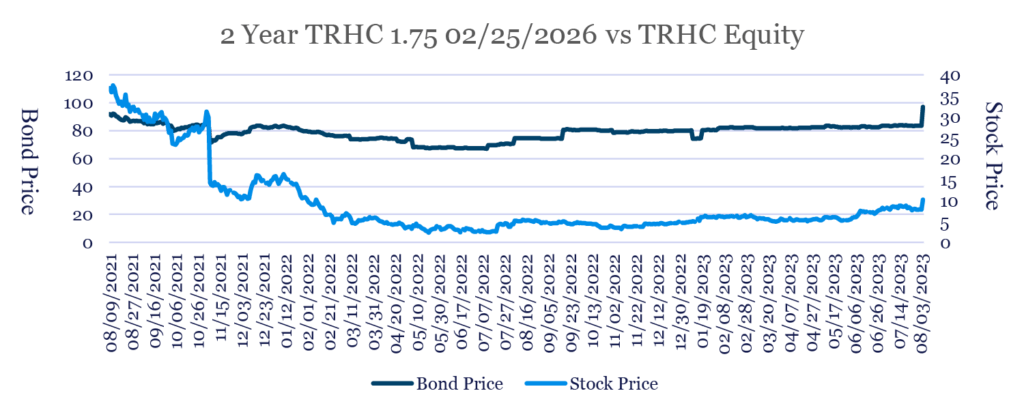

A prime example of this downside protection is the TRHC in the past 2 years. Despite positive returns of the S&P, the last two years saw a pronounced drawdown in high growth names particularly in technology and healthcare as investors liquidated 1H 2021 winners to fund the large cap rotation. Many software and biotech names sold off delivering negative returns. The downdraft helps illustrate the defensive nature of the convertible bond.

As the above graph illustrates, the convertible bond outperformed the underling equity as the equity declined. At the nadir, TRHC’s equity declined 93.75% while the convertible declined 26.66%. An investor owning the TRHC convertible bond from Austust 8th, 2021, to August 7th, 2023 when news of the deal hit, would have made +5.6%, versus equity owners losing -72.23%, beating the DOW, S&P, NASDAQ, and Russell 2000 Growth indices.

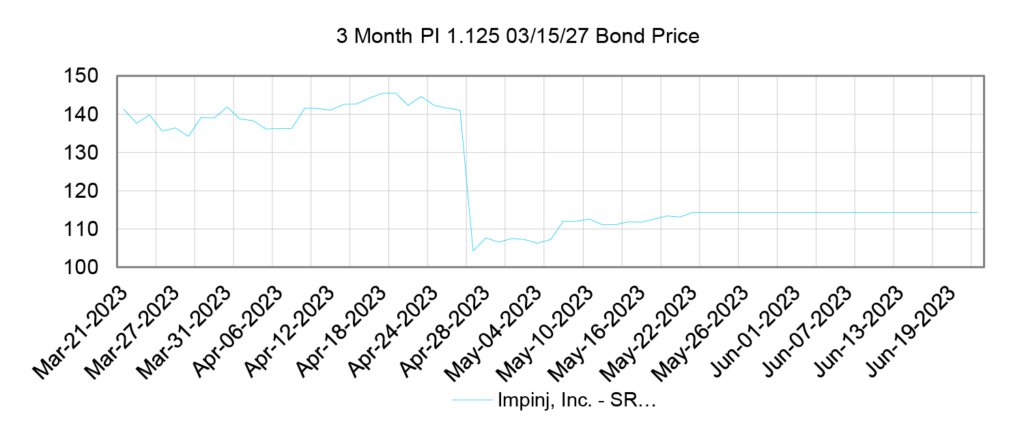

While TRHC is a prime example of convertible bond protection, the Impinj (“PI”) convertible bond shows the risk in holding a convert in times of liquidity uncertainty. A premium convertible bond such as PI 1.125 03/15/27 carries risk of significant losses if the company demonstrates credit and liquidity issues. At the end of FY 2022, the management team provided their forecast for over 12 months of cash run rate based off of their forecasts. Impinj reported earnings in late April missing EPS estimates and providing a low Q2 guidance, leading to fears that the unprofitable tech company was losing traction in their plan to profitability. Changes in liquidity and potential to repay debt can drastically alter how a bond, especially a premium bond, is traded and presents a large risk. In our view, it is important that an investor perform due diligence and underwrite a potential investment to help determine business, credit and liquidity risks.

Pier 88’s Investment Team believes the sharp pullback in small and midcap growth stocks recently will be a catalyst for more corporate M&A and private equity transaction. We view the convertible bond asset class as providing an interesting opportunity for the savvy investor to generate better returns from his or her fixed income investments without taking on excessive credit or duration risks. TRHC’s convertible makes the point. We believe getting access to great secular growth companies through investing higher in the cap table seems to be a creative and more defensive way to own growth stocks.

Respectfully,

Frank Timons

Footnotes

[1] Not all acquisitions are profitable. The positions can be acquired at a price that is less than the price at which the Firm purchased its interest for its clients. The information is being shown to reflect the Firm’s ability to select investments that are likely to be acquisition targets and not to reflect any positive investment experience. The holdings identified do not represent all of the securities purchased, sold, or recommended for Pier 88’s clients. It should not be assumed that investments made in the future will be profitable or will equal the performance of the securities in this list. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the account’s performance during the period will be provided upon request. Past performance is not indicative of future results.

Disclosures

This newsletter is a proprietary publication and the property of Pier 88 Investment Partners, LLC (“Pier 88”). The publication is written to express our view of the market and to explain our investment philosophy. It is not intended to provide specific investment advice or to guarantee that any past performance will be indicative of future performance results; investments may lose money. Certain statements contained in this newsletter (such as those that contain words like “may,” “will,” should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue,” or “believe”) are “forward-looking” insofar as they attempt to describe beliefs or future events. No representation or warranty is made as to future performance or such forward- looking statements. Any reproduction or other unauthorized use is strictly prohibited. All information contained in the newsletter was obtained from sources deemed qualified and reliable; however, Pier 88 makes no representation or warranty as to the accuracy of the information contained herein. All expressions of opinion are subject to change without notice in reaction to shifting market conditions.

This newsletter is for discussion purposes only and does not constitute: (i) investment advice; or (ii) an offer to sell or a solicitation of an offer to purchase securities, including any securities in funds managed by Pier 88. Any fund offering is made to selected investors only by means of a complete confidential offering memorandum and related subscription materials. Advisory services are provided to separately managed account clients pursuant to an advisory agreement.

The holdings identified do not represent all of the securities purchased, sold, or recommended for Pier 88’s clients. It should not be assumed that investments made in the future will be profitable or will equal the performance of the securities in this list. Additional information, including (i) the calculation methodology; and (ii) a list showing the contribution of each holding to the account’s performance during the period will be provided upon request. Past performance is not indicative of future results.

Russell 2000 Growth Index: Results as compared to the performance of the Russell 2000 Growth Index (“Russell 2000 Growth”) are provided for informational purposes only. Russell 2000 Growth is an unmanaged index of 2000 small cap companies located in the U.S. that also exhibit a growth probability. The investment program does not mirror this index and the volatility may be materially different than the volatility of the Indices.

S&P 500 Comparison: Results as compared to the performance of the Standard & Poor’s 500 Index (the “S&P 500”) is for informational purposes only. The S&P 500 is an unmanaged market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. The investment program does not mirror this index and the volatility may be materially different than the volatility of the S&P 500.

These materials are not intended to constitute investment advice or a recommendation within the meaning of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), Section 4975 of the Internal Revenue Code of 1986, as amended (the “Code”), or the Department of Labor regulations at 29 CFR 2510.3-21. If you are, or are using any assets of, or are acting on behalf of, an employee benefit plan subject to ERISA or a plan or account subject to Section 4975 of the Code (including, without limitation, an individual retirement account) (any of such entities, a “Plan”), you will be required prior to any new or additional investment in one of our funds or accounts to represent and warrant that: (i) the person or entity making the investment decision on behalf of the such Plan (the “Plan Fiduciary”) is independent of us and constitutes an independent fiduciary with financial expertise within the meaning of 29 CFR 2510.3-21; (ii) the Plan Fiduciary is capable of evaluating investment risks independently, both in general and with regard to particular transactions and strategies; (iii) the Plan Fiduciary is a fiduciary under ERISA, the Code, and 29 CFR 2510.3-21with respect to the investment in such fund or account and is responsible for exercising independent judgment in evaluating such transaction; and (iv) no fee or other compensation is being paid directly to us or to any of our affiliates in connection with such transaction. The Plan Fiduciary also will be required to acknowledge that we are not undertaking to provide impartial investment advice, or to give advice in a fiduciary capacity, in connection with the investment in any such fund or account, and that we have financial interests in the operation of such funds and accounts, which will be described in constituent documents of the funds and accounts.

DM #513

The companies identified do not represent all of the companies purchased, sold or recommended for portfolios advised by Pier 88 Investment Partners, LLC. The reader should not assume that investment in any company was or will be profitable. Additional information including a list of all companies is available upon request.